India’s total electricity generation increased 5.3 percent in the first half of 2018 due to higher demand.

Hydro-based production fell, but was offset by 5.4 percent jump in thermal electricity output and 86 percent rise in solar power generation, Fitch Ratings’ Rachna Jain and Muralidharan R said.

Thermal generation capacity rose 1.4 percent, which pushed utilisation levels by 2.2 pp to 57 percent in 1H18.

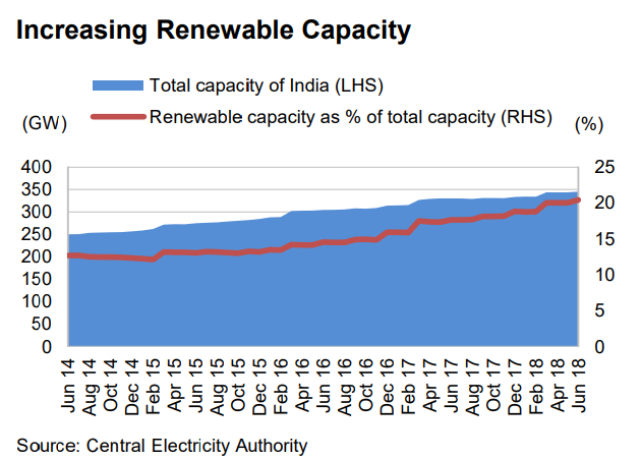

India’s total power capacity increased about 5 percent to 345GW by end-1H18, supported mainly by renewable capacity.

Utilisation factors at the national level were flat as total electricity generation rose at a similar pace.

Utilisation factors at the national level were flat as total electricity generation rose at a similar pace.

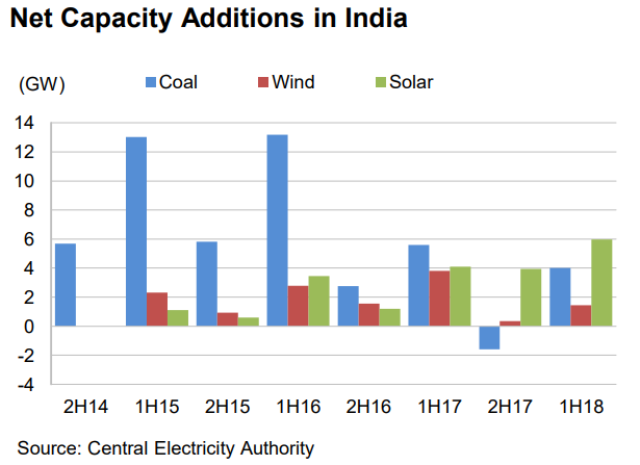

India added net capacity of 12GW in 1H18, of which 65 percent was renewable, marking another record contribution from the segment.

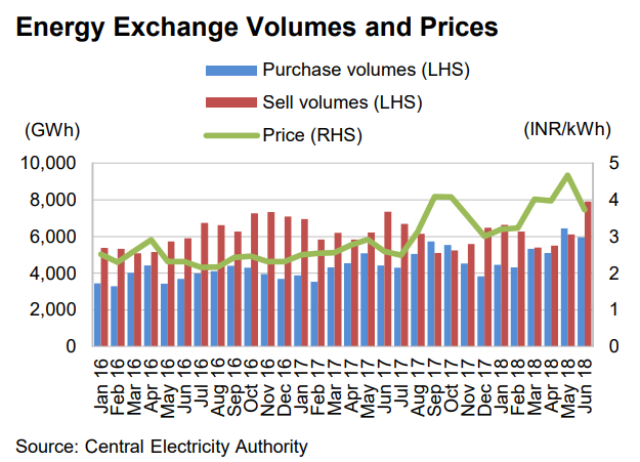

The tariff-based auction for wind power yielded prices of INR2.77/kWh in August 2018, with the increase from April due to higher financing cost and inadequate transmission facilities. Some solar tenders were not awarded recently because generators’ bids were at tariffs higher than previous lows.

“We believe the gap in tariff expectations of generators and utilities means fewer additions to renewable capacity in the short term,” Fitch Ratings’ Rachna Jain and Muralidharan R said in its report.

A combination of capacity additions, higher utilisation and better networks counteracted higher demand, resulting in the energy deficit in 1H18 staying at 0.6 percent.

A combination of capacity additions, higher utilisation and better networks counteracted higher demand, resulting in the energy deficit in 1H18 staying at 0.6 percent.

Distribution utilities are still shying away from signing new long-term power purchase agreements for thermal capacity as spot electricity remains affordable and available, and renewable contracts are cheaper.

Solar capacity could be derailed

6GW of solar capacity was added in 1H18, the largest half-yearly addition. In July 2018, the government imposed 25 percent duty on solar panels and modules from China and Malaysia. Solar developers could also have to pay higher taxes, while equipment prices could rise due to currency depreciation.

“These factors will raise costs for generators, whose bids for contracts at higher tariffs will probably be met with a cold shoulder in the short to medium term. Wind projects continue to face connectivity issues, with lacklustre growth prospects in the short to medium term,” said Fitch Ratings.