Global renewable capacity additions witnessed a staggering growth of nearly 50 percent, reaching an unprecedented 510 gigawatts (GW) in 2023.

This remarkable surge marks the fastest growth rate in the past two decades, setting a new record for the 22nd consecutive year. The surge in renewable capacity was particularly noteworthy in Europe, the United States, and Brazil, reaching all-time highs. However, China’s acceleration stood out, with the country commissioning as much solar photovoltaic (PV) capacity in 2023 as the entire world did in 2022. China’s wind additions also recorded a remarkable 66 percent year-on-year growth.

Solar PV emerged as the global frontrunner, contributing three-quarters of the total renewable capacity additions worldwide. The International Energy Agency (IEA) emphasized the crucial role of policy implementation in achieving the ambitious COP28 target, which aims to triple global renewable capacity by 2030.

COP28 Goals and Global Renewable Capacity Challenges

Prior to the COP28 climate change conference in Dubai, the IEA urged governments worldwide to support five key pillars of action by 2030, including the pivotal goal of tripling global renewable power capacity. The Global Stocktake text, agreed upon by 198 governments at COP28, incorporated several of the IEA priorities. The collective aim is to triple renewables and double the annual rate of energy efficiency improvements by 2030.

While the current trajectory under existing policies and market conditions forecasts global renewable capacity to reach 7,300 GW by 2028, it falls short of the tripling goal. Overcoming challenges in policy uncertainties, grid infrastructure, administrative barriers, and financing in emerging and developing economies is essential. The report suggests that addressing these challenges could result in nearly 21 percent higher growth of renewables, putting the world on track to meet the global tripling pledge.

Renewable Energy Expansion and Transformative Changes by 2028

The report forecasts a transformative shift in the global power mix by 2028, with the world set to add more renewable capacity in the next five years than in the entire century since the first commercial renewable energy power plant was built. Approximately 3,700 GW of new renewable capacity is expected to come online between 2023 and 2028, driven by supportive policies in over 130 countries.

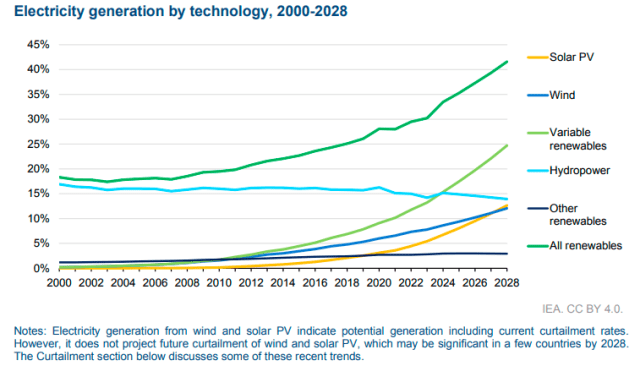

Notable milestones include wind and solar PV jointly generating more electricity than hydropower in 2024, renewables surpassing coal as the largest electricity generation source in 2025, and renewable energy sources accounting for over 42 percent of global electricity generation by 2028.

China’s Dominance and Key Growth Areas

China continues to be the global powerhouse for renewables, contributing almost 60 percent of new renewable capacity expected to be operational globally by 2028. Despite the phasing out of national subsidies in 2020 and 2021, China’s deployment of onshore wind and solar PV is accelerating, reaching its 2030 targets six years ahead of schedule. China’s role becomes critical in achieving the global goal of tripling renewables, as it is expected to install more than half of the new capacity required globally by 2030.

While China leads in renewable capacity, the United States, the European Union, India, and Brazil emerge as bright spots for onshore wind and solar PV growth. Supportive policy environments and improved economic attractiveness drive accelerated additions in these regions.

Solar PV Prices Decline, Onshore Wind and Solar PV Outpace Fossil Fuels

In 2023, solar PV module spot prices witnessed a nearly 50 percent year-on-year decline, with manufacturing capacity reaching three times 2021 levels. The global supply of solar PV is expected to reach 1,100 GW by the end of 2024, with onshore wind and solar PV proving to be cheaper than both new and existing fossil fuel plants. Almost 96 percent of newly installed utility-scale solar PV and onshore wind capacity in 2023 had lower generation costs than new coal and natural gas plants.

Macroeconomic Challenges and Industry Resilience

The new macroeconomic environment presents challenges for policymakers, with new renewable energy capacity in advanced economies facing higher base interest rates than in China and the global average. Despite challenges, the renewable energy industry, particularly wind, has exhibited resilience. The wind industry has launched initiatives to address market challenges, such as the European Union’s Wind Power Action Plan.

Challenges and Opportunities in Wind Industry

The wind industry, especially in Europe and North America, faces challenges due to supply chain disruptions, higher costs, and lengthy permitting timelines. The forecast for onshore wind outside China has been revised downwards, and offshore wind expansion has been hit hardest by the new macroeconomic environment.

Integration Challenges and Implications for Power Systems

The rapid expansion of solar PV and wind is expected to double their share in global electricity generation to 25 percent by 2028. This growth presents challenges for power systems worldwide, particularly in the European Union, where grid bottlenecks may lead to increased curtailment.

Hydrogen-Based Fuel and Biofuel Expansion

Renewable power capacity dedicated to hydrogen-based fuel production is forecast to grow by 45 GW between 2023 and 2028, with China, Saudi Arabia, and the United States accounting for over 75 percent of capacity. However, progress in planned projects has been slow, necessitating stronger policies and addressing supply chain challenges.

Biofuel deployment is accelerating globally, with emerging economies, led by Brazil, driving expansion. Biofuels and renewable electricity used in electric vehicles are forecast to offset 4 million barrels of oil-equivalent per day by 2028, offering a powerful combination for reducing oil demand.

Biofuels and Renewable Heat Consumption

Biofuel expansion, particularly in emerging economies, is set to grow 30 percent faster than in the last five years. Biofuels and renewable electricity used in electric vehicles are forecast to offset a significant portion of oil demand by 2028. However, aligning biofuels with a net-zero pathway requires a substantial increase in deployment pace, necessitating new policies and addressing supply chain challenges.

Renewable Heat Consumption and Insufficient Progress

Modern renewable heat consumption is projected to expand by 40 percent globally from 2023 to 2028, reaching 17 percent of total heat consumption. Despite positive trends in electrification and the deployment of heat pumps and boilers, this growth is insufficient to curb emissions in line with the Paris Agreement goals. Stronger policy action is needed to align with the Net Zero Emissions by 2050 Scenario.

In summary, the global renewable energy landscape is undergoing unprecedented growth, setting new records and transforming the power mix. While challenges exist, the report emphasizes the need for accelerated policy implementation, innovation, and international collaboration to meet ambitious targets and address the urgent global climate crisis.