The global landscape for low-emissions hydrogen is evolving rapidly, with a surge in announced projects and over 40 nations unveiling their hydrogen strategies, reports the International Energy Agency (IEA) in its annual Global Hydrogen Review 2023. Despite the swift growth in projects, low-emissions hydrogen accounts for less than 1 percent of overall hydrogen production and usage.

Potential Growth and Key Challenges Ahead

If all announced projects materialize, annual production of low-emissions hydrogen could reach 38 million tonnes by 2030, a remarkable 50 percent increase from 2022 projections. However, only 4 percent of this potential production has secured a final investment decision, posing financial challenges amidst a global energy crisis, inflation, and supply chain disruptions, IEA report said.

Slow Uptake and Challenges in Transition

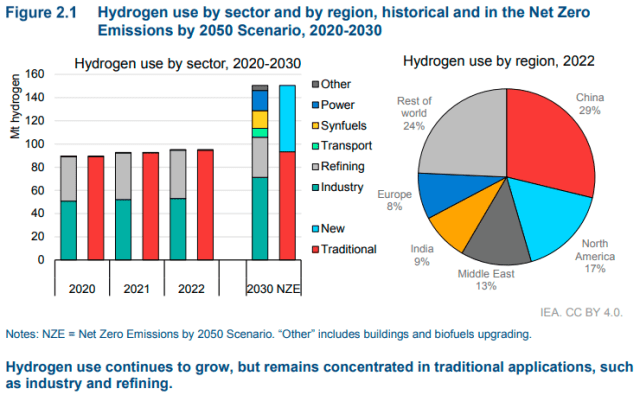

Low-emissions hydrogen demand remains sluggish, constituting just 0.7 percent of total hydrogen demand in 2022. The shift towards low-emissions hydrogen is impeded by economic obstacles and an industry still reliant on traditional applications.

Calls for Government Action and Collaboration

Calls for Government Action and Collaboration

IEA Executive Director Fatih Birol emphasizes the need for accelerated progress in technology, regulation, and demand creation to unlock low-emissions hydrogen’s full potential. The report outlines essential steps for governments, emphasizing effective delivery of support schemes, bolder demand stimulation actions, and global cooperation to establish standardized regulations and certifications for international hydrogen markets.

Accelerating Electrolyser Deployment

Electrolyser capacity is witnessing an upswing, with China accounting for half of the nearly tripling capacity expected by the end of 2023. The potential for electrolyser capacity to reach 420GW by 2030 is highlighted, underscoring the rapid evolution of hydrogen technologies.

Low-Emissions Hydrogen as a Climate Solution

Low-emissions hydrogen stands as a potential solution for climate goals, particularly in hard-to-abate industrial sectors. However, efforts to stimulate its demand are lagging, necessitating focused attention and strategic actions to meet ambitious climate targets.

A Call to Unleash Low-Emissions Hydrogen Potential

The IEA’s Global Hydrogen Review 2023 urges stakeholders to navigate economic challenges and ramp up efforts to realize low-emissions hydrogen’s full potential. With global cooperation and effective policies, low-emissions hydrogen can fuel a sustainable future and revolutionize industrial supply chains.

China Leads in Hydrogen Production

In 2020, China accounted for less than 10 percent of global electrolyser capacity installed for dedicated hydrogen production, concentrated in small demonstration projects.

In 2022, installed capacity in China grew to more than 200 MW, representing 30 percent

of global capacity, including the world’s largest electrolysis project (150 MW). By

the end of 2023, China’s installed electrolyser capacity is expected to reach 1.2 GW – 50 percent of global capacity – with another new world record-size electrolysis project (260 MW), which started operation this year.

China is poised to further cement its leading position in electrolyser deployment: the country accounts for more than 40 percent of the electrolysis projects that have reached FID globally.

Hydrogen Production Cost to Grow

For hydrogen produced from renewable electricity, for example, an increase of 3

percentage points in the cost of capital could raise total project cost by nearly onethird. Several projects have revised their initial cost estimates upwards by up to

50 percent.

Electrolyser Manufacturers Expansion Plans

Manufacturers have announced that around 14 GW of manufacturing capacity are

available today, half of which is in China. Electrolyser production in 2022 is

estimated to be just over 1 GW. Manufacturers have announced plans for further

expansion, aiming to reach 155 GW/year of manufacturing capacity by 2030, but

only 8 percent of this capacity has at least reached FID.