Solar stocks dazzled in 2020 and looked set to wrap up a year ravaged by the COVID-19 pandemic with triple-digit gains amid a shift in focus to clean energy as the outbreak decimated the global oil industry, Reuters reported.

Giving the rally a leg up was Joe Biden’s victory in the November U.S. presidential election, along with the coronavirus aid and funding bill that extended solar tax credits by two years.

The credits have helped reduce the cost of solar projects, and the extension pushed shares of solar equipment makers Enphase Energy, ReneSola and Canadian Solar, among others, to record or multi-year highs.

Years of disappointing shareholder returns by the oil and gas industry, this year’s pandemic and the clean energy push have encouraged investors to move their money out of traditional industries and into renewables, said Josh Sherman, partner at consultancy firm Opportune.

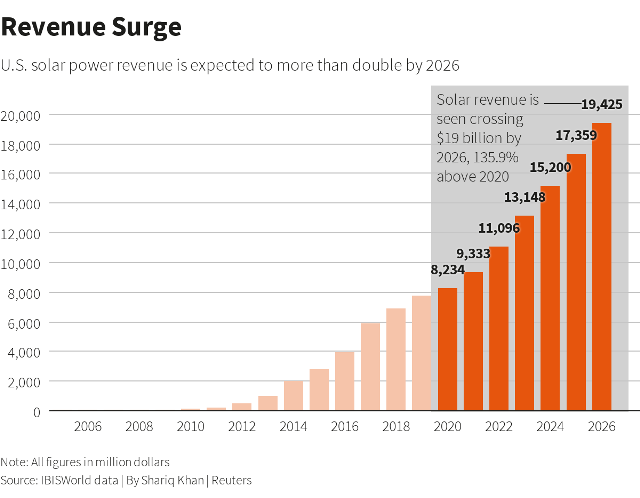

The coming years could be even better for the U.S. solar industry, and industry research firm IBISWorld estimates total revenue could cross $19.4 billion in 2026, more than double this year’s $8.23 billion.

Top solar trade group Solar Energy Industries Association and energy research firm Wood Mackenzie forecast U.S. solar installations will surge 43 percent this year, just shy of a pre-pandemic forecast, highlighting the industry’s quicker-than-expected recovery from a virus-related slowdown.

Stocks are expected to extend their rally too, and Sherman said investor appetite will only increase next year as the solar industry ramps up infrastructure.

Brokerage J.P. Morgan hiked its price targets across the board for renewable companies on Dec. 23, bumping its target on solar equipment maker Solaredge Technologies to $371 from $315.