Despite a decade of increased metals production, a new report by BloombergNEF (BNEF) reveals that the world may still fall short of the raw materials needed to meet growing demand for clean energy technologies.

The annual Transition Metals Outlook highlights a potential supply squeeze in key metals like aluminum, copper, and lithium, which could slow the adoption of electric vehicles (EVs), wind turbines, and other low-carbon technologies.

To achieve a net-zero emissions target by 2050, BNEF estimates that $2.1 trillion will need to be invested in new mining projects.

Kwasi Ampofo, head of metals and mining at BNEF, warned that deficits in primary metal supply could start as soon as this year, driving up raw material prices and increasing the overall costs of clean energy technologies. This could impede global progress toward energy transition.

The BNEF report forecasts that between 2024 and 2050, the world will need 3 billion metric tons of metals to build clean energy infrastructure. This number rises to 6 billion tons in a scenario aimed at achieving net-zero emissions by 2050.

Recycling is viewed as a key strategy to alleviate supply pressure. BNEF expects secondary metal sources to play a growing role, which could reduce the overall emissions of metal production. Allan Ray Restauro, a BNEF metals and mining associate, emphasized the importance of strong government policies to support battery recycling and lifecycle management.

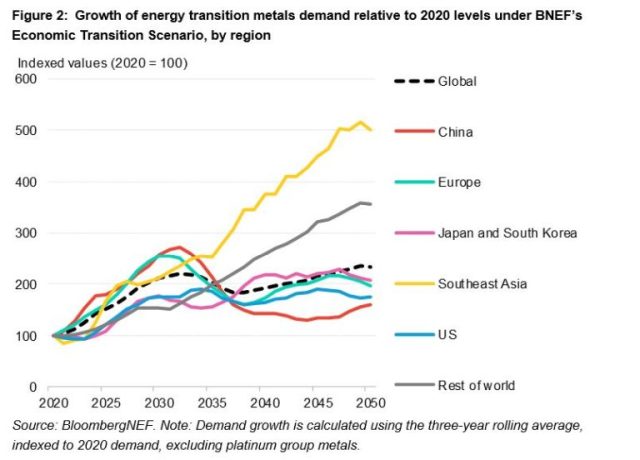

Regional demand for energy transition metals will vary, with China expected to peak by 2030, while Southeast Asia could become the fastest-growing market in the 2030s, potentially accelerating industrialization and contributing to global emissions reduction.