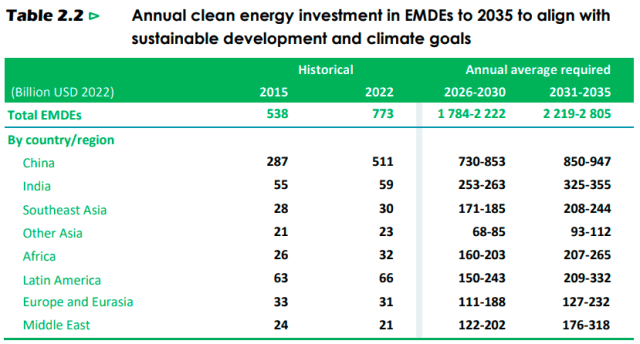

Annual investments in clean energy must more than triple in emerging and developing economies, says a new report released by the International Energy Agency (IEA) and International Finance Corporation (IFC) reveals.

The current investment of $770 billion in 2022 needs to reach as high as $2.8 trillion by the early 2030s to meet the increasing energy demands and align with the climate objectives outlined in the Paris Agreement, the report said.

Relying solely on public investments will not suffice in achieving universal energy access and addressing climate change, according to the report titled Scaling Up Private Finance for Clean Energy in Emerging and Developing Economies.

The report highlights the importance of leveraging private sector capital through blended finance, a concept that combines public funding with private investment to mitigate project risks. It suggests that two-thirds of the financing for clean energy projects in emerging and developing economies (excluding China) should come from the private sector. Currently, annual private financing for clean energy in these economies amounts to $135 billion, which needs to increase to approximately $1.1 trillion within the next ten years.

Fatih Birol, Executive Director of the IEA, emphasized the urgency of investment to ensure that countries can benefit from the rapidly emerging global energy economy. Public financing alone falls short of meeting the investment requirements, underscoring the need to significantly scale up private financing for clean energy projects in emerging and developing economies.

The report stresses the necessity of international support in the form of technical expertise, regulatory frameworks, and financial aid to unlock the potential of clean energy in emerging and developing economies (EMDEs). By strengthening regulatory frameworks, energy institutions, infrastructure, and access to finance, governments can overcome current obstacles to clean energy investments, such as high upfront costs and elevated capital expenses.

Makhtar Diop, Managing Director of the IFC, highlighted the significance of mobilizing private capital at a rapid pace and on a large scale to address the energy demands and emissions reduction goals in EMDEs. He described the report as a call to action and a roadmap for meeting both climate and energy objectives.

The report recognizes the importance of concessional financing for projects involving newer technologies that have not yet reached cost competitiveness or scaled in many markets. Examples include battery storage, offshore wind, renewable-powered desalination, low-emissions hydrogen, and ventures in riskier markets.

The report estimates concessional finance of $80-$100 billion annually will be necessary by the early 2030s to attract private investment on the scale required for the energy transition in emerging and developing economies outside China.

The report identifies the potential for issuing more green, social, sustainable, and sustainability-linked bonds. However, it emphasizes the need for industry guidelines, harmonized taxonomies, and robust third-party certification.

The report also highlights the opportunity provided by platforms that aggregate and securitize multiple investments, thereby bridging the gap between the relatively small size of energy transition projects in emerging and developing economies and the higher minimum investment size preferred by major institutional investors.

To expand opportunities for private investors, the report emphasizes the need for policy reforms in emerging and developing economies. It points out several cross-cutting policy issues, such as fossil fuel subsidies, lengthy licensing processes, unclear land use rights, restrictions on private or foreign ownership, and inappropriate pricing policies. Addressing these barriers will enable emerging and developing economies to fully benefit from the opportunities presented by the new global energy economy.