The planned global carbon capture, utilization and storage (CCUS) capacity pipeline has reached 905 million tons per annum (mtpa), with more than 50 new projects announced this quarter, says Wood Mackenzie.

“Despite momentum in the CCUS pipeline, much more progress is required to meet 2050 greenhouse gas targets. Currently, the CCUS capacity pipeline is close to aligning with Wood Mackenzie’s 1.5-degree pathway to 2030, but it will need to grow seven-fold by 2050 to reach the capacity required for net zero,” Lucy King, Senior Research Analyst at Wood Mackenzie, said.

The challenge is the lack of embedded policy and regulation for CCUS projects. For most countries, the rate of growth and demand for CCUS is outpacing the respective government’s ability to legislate.

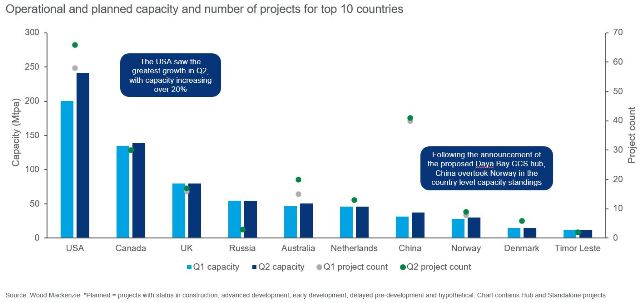

The US is a global leader in CCUS, supported by its 45Q tax credit incentive for carbon sequestration launched in 2008. On 16 August 2022, President Joe Biden signed the Inflation Reduction Act (IRA) into law, which will enhance and extend the 45Q tax incentive.

The Inflation Reduction Act bill will further accelerate the US’ planned CCUS capacity pipeline, which is currently at almost 250 Mtpa. It will incentivise smaller-scale capture projects, attract more industries, and promote investment into technologies including Direct Air Capture.

Great strides have also been made for licensing and permitting for geological CO2 storage throughout Q2 of 2022. The industry has seen an increase in licensing activity in Norway, Russia and Australia, with the UK launching the ‘first of its kind’ CO2 storage licensing round which consists of 13 areas across the North Sea.

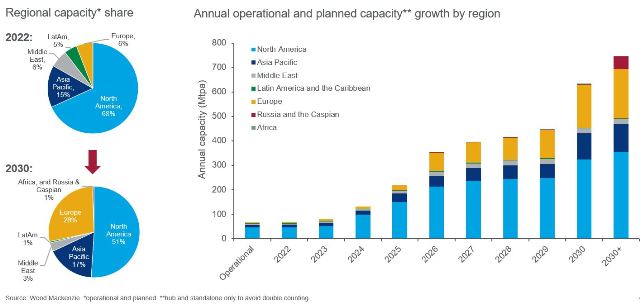

North America and Europe continue to emerge as hotspots for CCUS activity, according to latest Wood Mackenzie research. North America accounts for over two thirds of current global capacity in 2022, with activity mainly focused in Alberta, the Gulf Coast and US Midwest.

North America’s share of global CCUS capacity is expected to reduce to 50 percent by 2030 as hub projects across Europe scale up.

China and Southeast Asia are forecasted to have the biggest demand for CCUS in the 2040s, but this will require further regulatory and policy implementation.