The Organization of the Petroleum Exporting Countries (OPEC) unveiled its first-ever forecast for 2025 in its monthly report released on Wednesday.

The report maintains OPEC’s expectation of robust growth in global oil demand for 2024, with an even more substantial increase anticipated in 2025. This earlier-than-usual prediction underscores OPEC’s commitment to providing long-term guidance for the market.

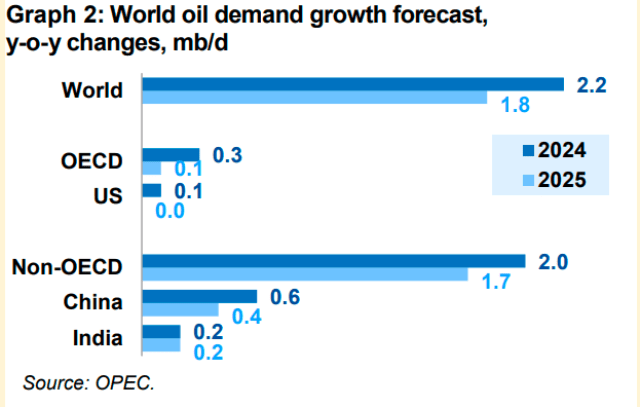

According to the monthly report, OPEC predicts that there will be a significant rise in world oil demand, projecting an increase of 1.85 million barrels per day in 2025. The forecast for 2024 remains unchanged at 2.25 million barrels per day, aligning with last month’s projections. OPEC aims to extend its forecasting horizon, moving beyond conventional short-term predictions, to enhance market understanding and navigate evolving dynamics.

“The undertaking to reach beyond the previously established time horizon of short-term forecasting serves to support the understanding of market dynamics,” stated OPEC in its report.

It is noteworthy that OPEC’s forecast for 2024 consistently predicts stronger demand growth compared to other entities such as the International Energy Agency. This divergence has led to clashes between the two organizations in recent years, particularly regarding long-term demand and the imperative for investment in new supplies.

The report also highlighted a slight increase in OPEC oil production in December, primarily driven by Nigeria. This uptick occurred despite ongoing output cuts implemented by the broader OPEC+ alliance to stabilize the market. OPEC adjusted its production figures downward to account for Angola’s departure from the group, a decision announced by Luanda last month. This development further underscores the intricacies of OPEC’s efforts to balance production levels amid evolving global circumstances.

Oil Prices Experience Decline

The OPEC Reference Basket (ORB) value witnessed a notable decline of $5.92, or 7.0 percent, month-on-month in December, averaging $79 per barrel. The ICE Brent and NYMEX WTI front-month contracts also experienced drops of $4.71 (5.7 percent) and $5.26 (6.8 percent), respectively. The DME Oman front-month contract settled at $76.83/b, marking a $6.23 (7.5 percent) decrease month-on-month.

Global Oil Demand and Supply

The global oil demand growth forecast for 2024 remains unchanged at 2.2 mb/d, with the OECD expected to grow by approximately 0.3 mb/d and the non-OECD by around 2.0 mb/d. Looking ahead to 2025, a robust growth of 1.8 mb/d is anticipated, with OECD growth projected at 0.1 mb/d and non-OECD demand expected to increase by 1.7 mb/d.

In terms of oil supply, non-OPEC liquids production in 2024 is expected to grow by 1.3 mb/d, slightly revised down from the previous month’s assessment. The primary drivers for this growth are anticipated to be the United States, Canada, Guyana, Brazil, Norway, and Kazakhstan. In 2025, non-OPEC liquids supply growth is expected to stand at 1.3 mb/d, predominantly driven by the United States, Brazil, Canada, Norway, Kazakhstan, and Guyana.

OPEC Crude Oil Production and Refining Operations

OPEC natural gas liquids (NGLs) and non-conventional liquids are forecasted to grow, reaching an average of 5.5 mb/d in 2024 and expanding to 5.6 mb/d in 2025. OPEC-12 crude oil production increased by 73 tb/d month-on-month in December 2023, averaging 26.70 mb/d, as per available secondary sources.

In the refining sector, margins in the Atlantic Basin declined in December 2023 due to higher refinery product output levels and rising product availability, following seasonal trends. Despite some support over the year-end holidays, certain markets, such as gasoline in the US Gulf Coast and Rotterdam, faced challenges. Refinery intake globally rose by 1.5 mb/d month-on-month in December 2023, reaching an average of 82.3 mb/d.