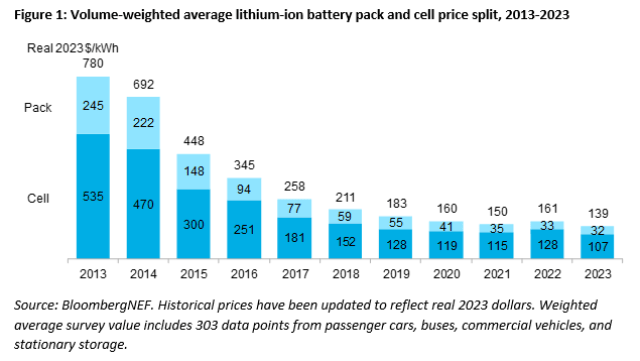

In a significant turnaround from the unprecedented price hikes witnessed in 2022, battery prices have taken a noteworthy nosedive this year. According to research conducted by BloombergNEF (BNEF), the price of lithium-ion battery packs has plummeted by 14 percent to an all-time low of $139/kWh. This remarkable decline stems from a convergence of factors, including the reduction in raw material and component costs amidst a surge in production capacity across the battery value chain, despite demand growth falling short of industry projections.

The report forecasts a substantial 53 percent year-on-year growth in battery demand for electric vehicles (EVs) and stationary energy storage, anticipating a monumental rise to 950 gigawatt-hours in 2023. However, major battery manufacturers have reported lower utilization rates for their plants, coupled with demand and revenue falling below initial expectations. Consequently, several EV and battery manufacturers have recalibrated their production targets, influencing the downward trajectory of battery prices. Lithium prices, which reached a pinnacle at the close of 2022, have since embarked on a downward trend.

Evelina Stoikou, BNEF’s energy storage senior associate and lead report author, contextualized this year’s price decline within the framework of fluctuating raw material prices. Traditionally, falling prices have been attributed to scale learnings and technological innovations. However, the recent drop is attributed to a significant surge in production capacity across the value chain, compounded by lower-than-projected demand.

The analysis delineates the average prices across diverse battery end-uses, encompassing electric vehicles, buses, and stationary storage projects. Battery electric vehicle (BEV) packs averaged $128/kWh in 2023 on a volume-weighted average basis, with cell-level prices for BEVs hovering at just $89/kWh. This shift indicates that cells now constitute 78 percent of the total pack price, marking a deviation from the traditional 70:30 split over the past four years, largely attributed to innovative pack designs like cell-to-pack approaches that have facilitated cost reductions.

Regionally, average battery pack prices were lowest in China, at $126/kWh, while the US and Europe registered 11 percent and 20 percent higher prices, respectively. Factors contributing to the variance in prices include market maturity, production costs, volume differences, and varied applications, with intense price competition witnessed in China due to heightened domestic production capacity.

The industry’s gradual shift towards the cost-efficient lithium iron phosphate (LFP) cathode chemistry has led to notably lower global weighted-average prices for LFP packs and cells, standing at $130/kWh and $95/kWh, respectively. This year marks a significant milestone as LFP average cell prices dip below $100/kWh for the first time, boasting a 32 percent cost advantage over lithium nickel manganese cobalt oxide (NMC) cells in 2023.

Forecasts by miners and metals traders anticipate further easing of prices for key battery metals in 2024. In line with this projection, BNEF expects average battery pack prices to decrease further next year, reaching $133/kWh in real 2023 dollars. Technological advancements and manufacturing enhancements are anticipated to perpetuate this downward trajectory, driving battery pack prices to $113/kWh in 2025 and an impressive $80/kWh by 2030.

Yayoi Sekine, head of energy storage at BNEF, highlighted the dynamic nature of battery prices, observing localization efforts in the US and Europe as pivotal factors. These localization initiatives, while potentially adding complexity to regional battery prices, are expected to witness offsetting through production incentives and regulatory measures on critical minerals. The localization of battery manufacturing in these regions, although more costly due to higher operational expenses, holds promise in navigating the evolving landscape of battery pricing.

Ongoing investments in research and development, alongside capacity expansion throughout the supply chain, are projected to propel technological advancements, thereby reducing costs over the next decade. Next-generation technologies, including silicon and lithium metal anodes, solid-state electrolytes, novel cathode materials, and innovative cell manufacturing processes, are anticipated to play a pivotal role in driving further reductions in battery prices.